Ira interest calculator

Enter your current IRA balance. Enter the Initial Investment Amount Enter the Annual Interest Rate Put the number of months the money is invested At this point the Compound Interest Calculator Roth IRA will process and give you the output.

Roth Ira Calculators

Compound interest is calculated using the compound interest formula.

. IRS interest calculator online will make the life of taxpayers who need to compute the interest on outstanding tax very easily that IRS computes interest every time it calculates penalty for failure to pay or penalty for failure to deposit. 100 10 110 However the year ends and in comes another period. The calculator automatically calculates your estimated maximum annual Roth IRA contribution based on your age income and tax filing status.

To determine an interest payment simply multiply principal by the interest rate and the number of periods for which the loan remains active. For the first year we calculate interest as usual. While long term savings in a Roth IRA may produce better after-tax returns a traditional IRA may be an excellent alternative if you qualify for the tax deduction.

Compound It Compound Frequency Times per year that interest will be compounded. Use Bankrates loan interest calculator to find out your total interest on any loan. You can easily perform this calculation using our Compound Interest Calculator Roth IRA.

IRC 6621 Interest is computed to the nearest full percentage point of the Federal short term rate for that calendar quarter plus 3. A taxpayer needs to pay not only tax but penalty and interest. Tax-Deferred Yields Where the IRA comes into in play is in the fact that it keeps your interest working for.

Interest income can also be subject to another tax called the Net Investment Income Tax NIIT. For example if one person borrowed 100 from a bank at a simple interest rate of 10 per year for two years at the end of the two years the interest would come out to. The NIIT is a 38 tax on the lesser.

More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. You can print the results for future reference and rest assured your data will not be saved online. Traditional IRA Calculator Details To get the most benefit from this calculator you.

Where r is in decimal form. Calculate Interest solve for I I Prt Calculate Principal Amount solve for P. The 1-Year IRA CD also called a 12 Month IRA is offered with the highest interest rates by credit unions followed by online banks.

Get started by using our Schwab IRA calculators to help weigh your options and compare the different accounts available to you. Date Factor Explanation Interest. 2018-07 by the amount owing.

100 10 10 This interest is added to the principal and the sum becomes Dereks required repayment to the bank for that present time. IRS Interest Formula Interest Amount Amount Owed Factor Interest Amount Amount Owed 1 Daily Rate days - 1 Interest Amount Amount Owed 1 Daily Rate days - Amount Owed IRS Interest Rates Table. You can use this calculator to help you see where you stand in relation to your retirement goal and map out different paths to reach your target.

The Interest Rate Calculator determines real interest rates on loans with fixed terms and monthly payments. If you have a 500000 portfolio download 13 Retirement Investment Blunders to Avoid. R and t are in the same units of time.

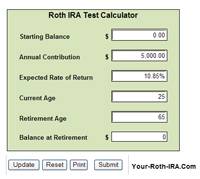

Enter the amount of your contributions per year. You can adjust that contribution down if you plan to. For example it can calculate interest rates in situations where car dealers only provide monthly payment information and total price without including the actual rate on the car loan.

The interest calculation is initialized with the amount due of. Your retirement is on the horizon but how far away. 2018-07 Calculate interest by multiplying the factor provided in Rev.

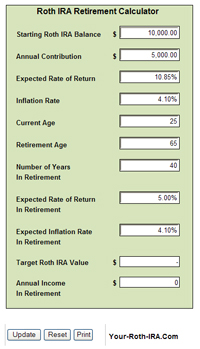

Roth IRA calculator. Calculate Your Potential Investment Returns With the Help of AARPs Free Calculator. Use our traditional IRA calculator to see how much your nest egg will grow by the time you reach retirement.

To calculate your future value multiply your initial balance by one plus the annual interest rate raised to the power of the number of compound periods. Your estimated annual interest rate. AARP Updated May 2022 Traditional IRA Calculator Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth.

39 rows Furthermore the IRS interest rates which this calculator uses are updated at the end of each tax quarter. Ad This guide may help you avoid regret from certain financial decisions with 500000. Interest rate variance range Range of interest rates above and below the rate set above that you desire to see results for.

Traditional IRA Calculator Calculate your earnings and more Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth. Enter the percentage of your expected rate of return the percentage you anticipate your portfolio to grow Enter the marginal tax rate you anticipate to have at retirement. This calculator for simple interest-only finds I the simple interest where P is the Principal amount of money to be invested at an Interest Rate R per period for t Number of Time Periods.

Subtract the initial balance. 100 10 2 years 20. The APY of a 1 percent account with daily compounding is approximately 1005 percent.

Using this compound interest calculator Try your calculations both with and without a monthly. Interest earned on your CDs accumulated interest. In our rate table above you can view membership requirements for the corresponding credit union by clicking the plus button to the left of the institutions name.

Enter the number of years until your retirement. Ad Understand The Potential Returns You Might Receive From Investments. This calculator allows you to choose the frequency that your CD.

Ad True Investor Returns with No Risk Find Out How with Your Free Report Now. Use the compound interest calculator above to see how big a difference it could make for you. With our IRA calculators you can determine potential tax implications calculate IRA growth and ultimately estimate how much you can save for retirement.

For the 2020 and 2021 tax years there are seven tax brackets. Ad We Reviewed the 10 Best Gold IRA Companies For You to Protect Yourself From Inflation.

Ira Calculator See What You Ll Have Saved Dqydj

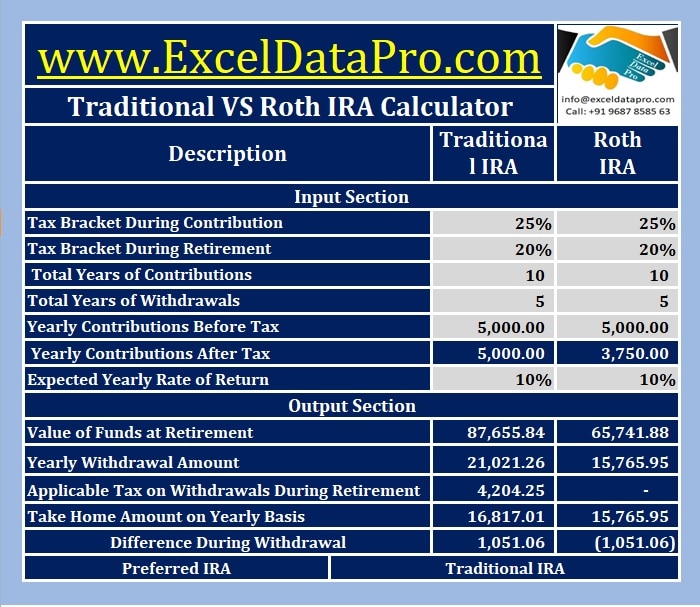

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

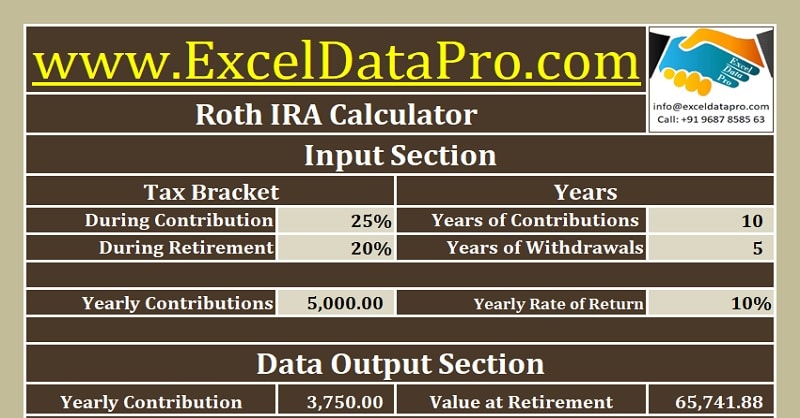

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Traditional Vs Roth Ira Calculator

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Top 5 Best Roth Ira Calculators 2017 Ranking Conversion Contribution Growth Retirement Early Withdrawal Calculators Advisoryhq

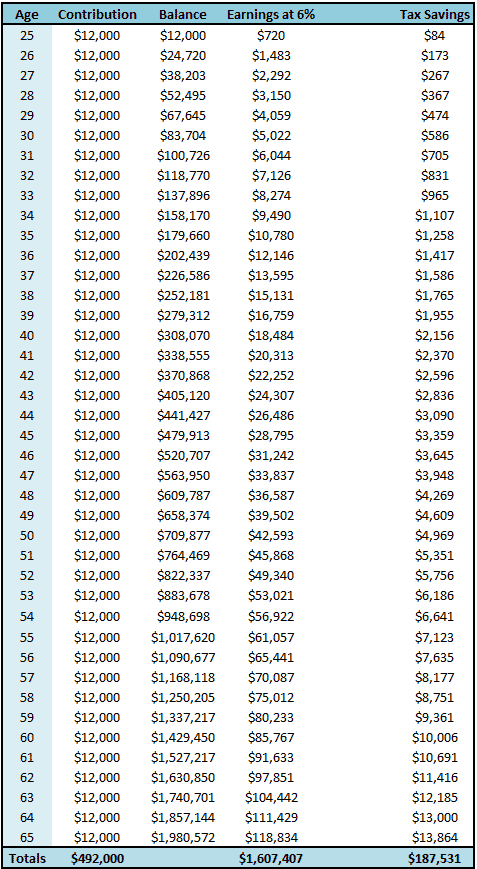

Calculating The Value Of Your Backdoor Roth Contributions Physician On Fire

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Download Roth Ira Calculator Excel Template Exceldatapro

This Could Be The Perfect Stock For A Roth Ira Nyse O Seeking Alpha

Roth Ira Calculator Roth Ira Contribution

Roth Ira Calculators

Roth Ira Calculators

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Traditional Vs Roth Ira Calculator

Ira Kids Compound Interst Growth Of Roth Iras A Kid S Key To Future Wealth